Why don't we ask Mike Beebe why Arkansas taxes are so high?

-------------------------------------

FORT SMITH - Arkansas ranks in the top ten, but this list isn't one the state wants to be on. In the first of a two-part story, 5NEWS reporter Jared Broyles investigates why you're paying the high price of high taxes in Arkansas.

"In my opinion it is a death spiral," KFSM financial expert John Taylor said.

Arkansas ranks among the top 10 states for the worst tax climate. When it comes to overall taxes, we rank 41st among the 50 states. Arkansas does even worse when you look at the business tax index -- a low score at 44. Those numbers from the non-profit Tax Foundation are cause for concern.

Commenting on the report, Rogers mayor Steve Womack said, "It does not portray a very good picture for business development in our state."

Neighboring Oklahoma does much better at 17 and 8. The Sooner State is nearly two dozen spots higher than Arkansas overall and far better for business.

"We're losing more and more jobs to offshore. We're losing more and more jobs to other southern states that have conservative governors who are cutting taxes and calling up industry and saying, we're open for business," state senator Denny Altes said.

So, how did we get here, where the tax burden has become too much to bear?

Republican candidate for governor Asa Hutchinson explains:

"The past two decades if we had a need in education or roads or any other social needs in our state we raised the taxes to meet that need. Now we're to the point where we can't really do that anymore."

Mike Beebe, the state's current attorney general and Democratic candidate for governor agrees.

"I've been saying all along that our state income tax and our state sales tax which the two primary taxes which support state government have gotten to the point where they're not competitive."

And that's bad for business.

"So if you're going to pay somebody an hourly wage, they can only spend what's left over after taxes," Taylor explained. "so, if you go to a state where an employee has more left over after taxes, then its logical that you would have to pay them a little less money than if you went to a state where the tax climate was much higher."

States like Texas, Tennessee and Florida that don't have a personal income tax.

Arkansas leaders worry that businesses and residents will run for the borders. Just take a family of four with an average household income of $50,000. In Texas and Tennesee they would pay no state income tax. In Oklahoma, the family would pay about $2,100. And in Arkansas, if the couple files jointly they would pay $200 more. But if they file separate tax returns in the Natural State, they would actually save $400 more than if they lived in Oklahoma.

But it's wealthy Arkansans who have the most to lose, and choose to move so they don't have to pay the price. Financial expert John Taylor points out that few that made their fortune in Arkansas continue to live here. Like the founding family of Wal-Mart: only two Waltons haven't fled the state.

"You say, 'Well shouldn't those people pay income tax?'" Taylor questioned. "Well, would you rather have a little of their money or none of their money?"

State senator Denny Altes of Fort Smith agrees:

"If the wealthy people are leaving with their money then where does that leave us the poor people? Behind to pay the taxes."

But, they say money isn't all Arkansas is losing. The state is also losing its minds.

"More and more of our bright young people that we educate with our tax dollars will go to Texas, and Tennessee and other places," Taylor warned.

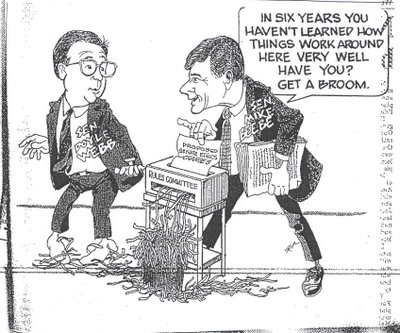

Senator Denny Altes says the state has a surplus: one billion dollars banked in less than three years. He says some of that money should be used to pay for current programs and help lift the tax load, but Altes says other state legislators have ideas of their own.

"It's a vicious cycle, and the people say we want to save, we want to keep it, but we don't save, we don't keep it," he said. "We spend it on existing programs to expand them and we create new programs to expand government."

Altes says the fear of a future recession has legislators hoarding money in Little Rock instead of spending the surplus to lighten Arkansans' tax loads. Taylor says this is a wake-up call.

"I think its eventually going to stop the growth in Northwest Arkansas," Taylor predicted.

However, economist Dr. John Shelnutt with the Arkansas Department of Finance and Administration warns Arkansans about reading too much into the Tax Foundation's report. He says what's interesting about the study is that the methodology is skewed towards flat tax. According to him, the foundation awarded higher points for states that had a flat tax structure, a smaller number of tax brackets, or no tax in a major category. Dr. Shelnutt says the vast majority of the weight of the index and ranking is by that structure.

Shelnutt says when you look at Arkansas compared to Arizona, the entire difference came from bias toward flat tax structure. He believes even a state with a higher marginal tax rate than Arkansas would look better in the rankings if it has fewer brackets. (KFSM)